Why Is Bitcoin Going Up in May 2024

Since its lows in 2022, Bitcoin more than tripled in value before retracing slightly following the exchange-traded fund (ETF) launches. Why is Bitcoin up, and what makes Bitcoin go up? The newly launched Bitcoin ETFs and Bitcoin halving help explain the recent runup, with the hype-fueled surge beginning in October.

Bitcoin’s ups and downs are legendary, with fortunes made — and sometimes lost — during Bitcoin’s relatively short 15-year existence. From euphoria to frozen fear, emotion is often at the heart of big moves for the largest cryptocurrency. In this article, we dig into the data to explain the current uptrend but also examine Bitcoin’s viability as a long-term investment given its volatility.

Key Takeaways: Why Is Bitcoin Going Up Today?

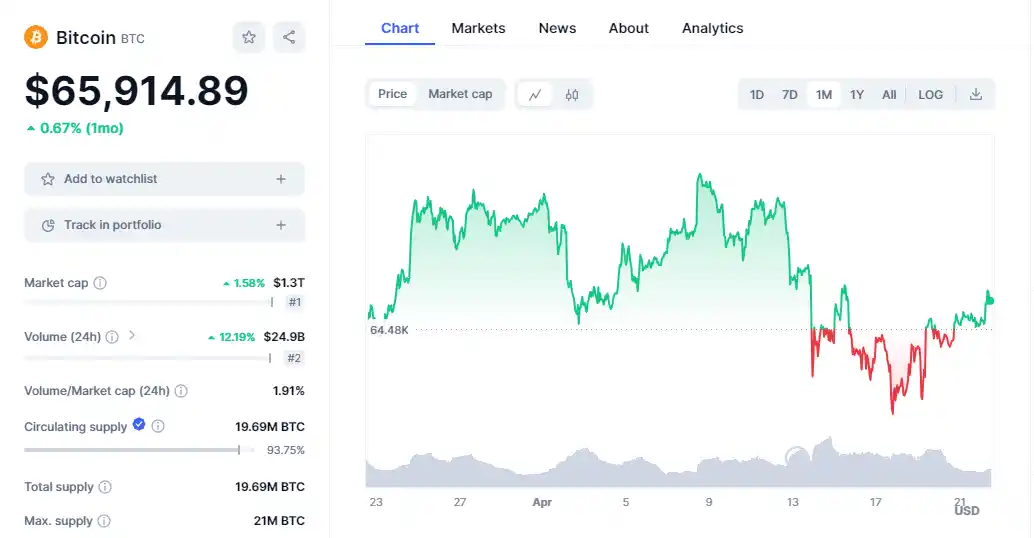

- Bitcoin climbed 5.5% to $64,327, erasing prior day losses and signaling a broader market recovery.

- Bearish crowd sentiment, typically a sign of market bottoms, suggests a potential price reversal.

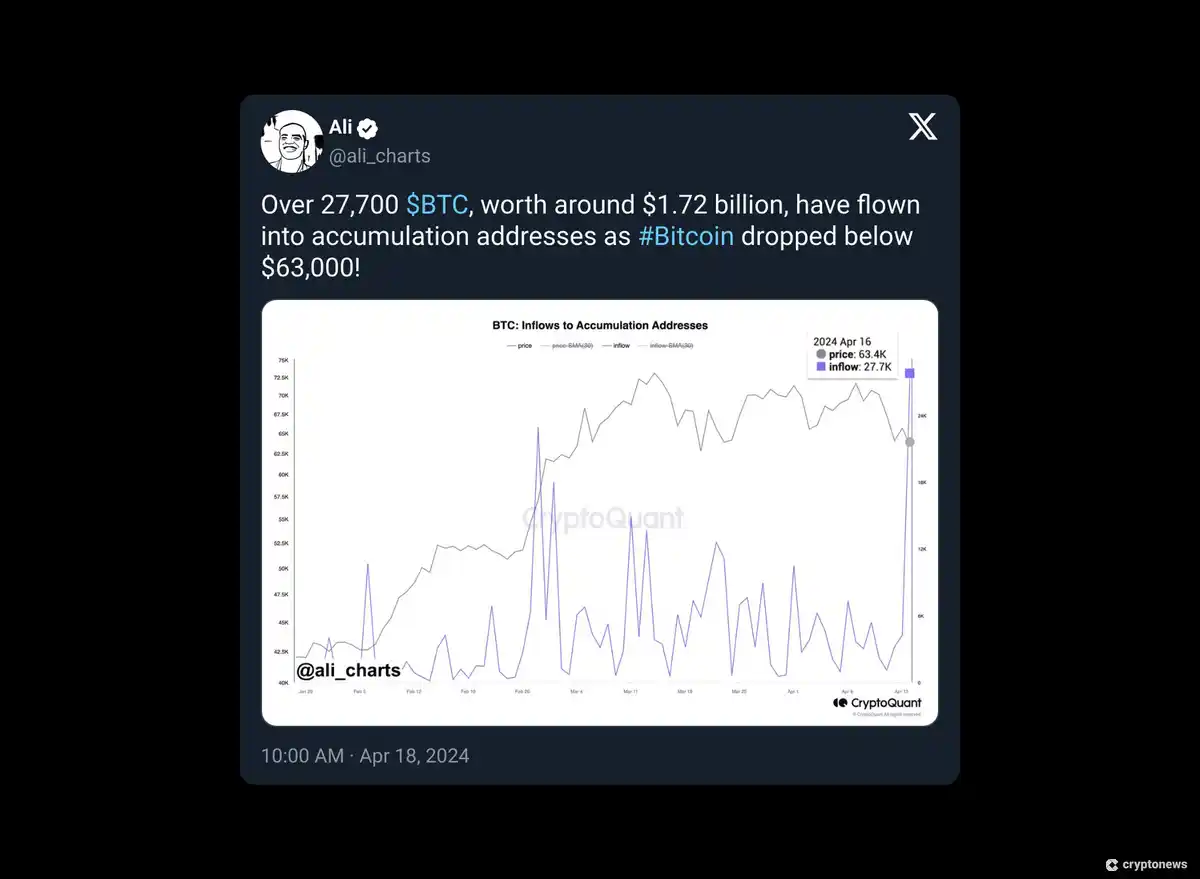

- Significant inflows to accumulation addresses and reduced deposits to exchanges indicate strong holding sentiment, bolstering price stability.

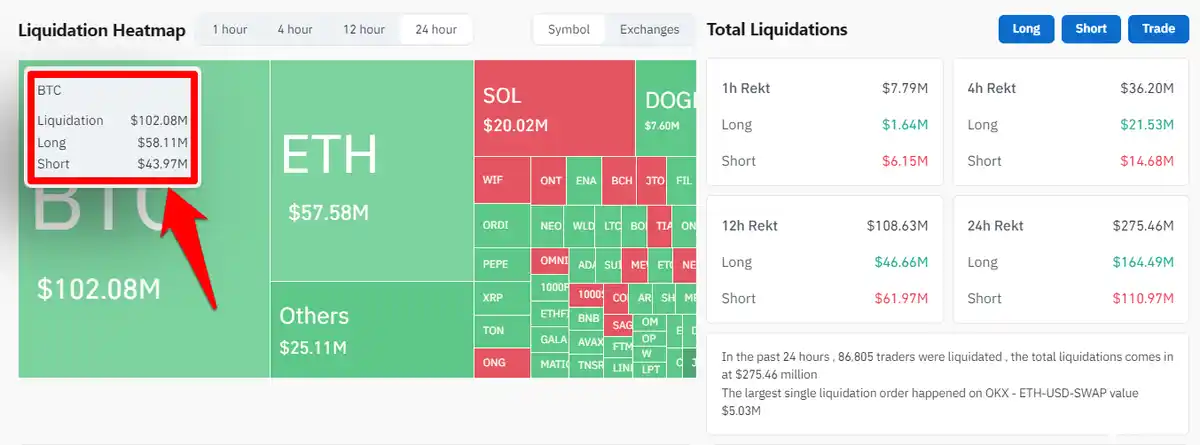

- Over $43.97 million in BTC short positions were liquidated in the last 24 hours, driving further price increases.

- The recent Bitcoin halving has cut miner rewards, historically leading to price increases, also supported by the recent introduction of spot Bitcoin ETFs.

Why Is Bitcoin Going Up Right Now?

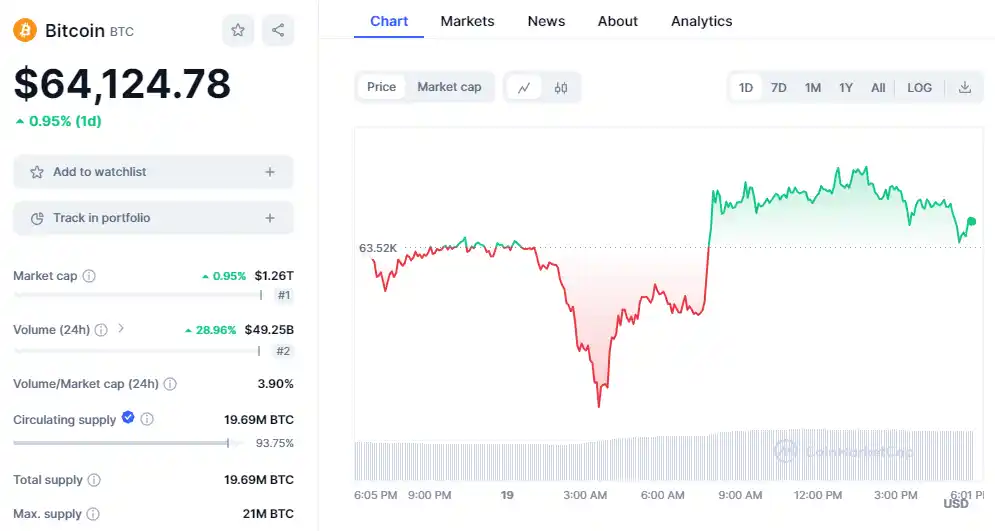

Bitcoin recently surged to $64,327, currently standing at $64,124. This marks a significant rebound, as it climbed 5.5% from an opening price of $60,618 on April 18, erasing the previous day’s losses.

This uptick is part of a broader crypto market recovery, but several factors bolster Bitcoin’s value specifically. These include bearish sentiment, Bitcoin accumulation, short liquidations, and the Bitcoin halving. Let’s break them down.

Market intelligence from Santiment highlights a shift in crowd sentiment to bearish, particularly after Bitcoin’s drop. Historically, this sentiment often signals market bottoms, suggesting a potential reversal. As bearish views accumulate, history shows prices typically trend opposite to crowd expectations.

Moreover, data from CryptoQuant indicates increased accumulation activity, with significant Bitcoin inflows to accumulation addresses and a marked decrease in BTC deposits to exchanges. This pattern suggests a strong holding sentiment among investors, diminishing the sell-off pressure and supporting price stability.

A sharp uptick in Bitcoin’s price has triggered substantial short liquidations. According to CoinGlass’s liquidation heatmap, over the last 24 hours, $43.97 million in BTC short positions were liquidated, contributing to the price surge. These liquidations typically propel further upward movements as market dynamics squeeze short sellers.

The recent Bitcoin halving, which reduced miner rewards from 6.25 to 3.125 BTC, is another factor driving the current price increase by constraining new supply. Historical trends suggest these events boost Bitcoin’s value. This event, coupled with the introduction of spot Bitcoin ETFs earlier this year, is expected to boost demand and support Bitcoin’s long-term price growth.

How Do I Know if Bitcoin Is Going to Go Up or Down?

Bitcoin price predictions cover a wide span and long time range, but understanding Bitcoin’s ups and downs helps make sense of price moves when investing for the long run.

It’s helpful to take a step back and look at the big picture to get a sense of long-term direction. Longer time frames help reduce the noisy signals of daily gyrations.

Several market forces make Bitcoin’s price go up or down:

- Halving cycles: Every 210,000 blocks, Bitcoin halves the amount of Bitcoins minted as mining rewards. As supply grows at a slower pace, Bitcoin’s price often increases in the months following the halving.

- Industry events: For example, the collapse of Terra Luna, which led to the collapse of Three Arrows Capital and Celsius, crashed the crypto market. Forced selling and fear took down BTC, ETH, and other high-flying cryptocurrencies. Bitcoin news often move the market.

- Leverage events: For instance, a selloff dropped BTC’s price by nearly 8% in an instant. The suspected cause: deaveraging. CoinGlass data showed $500 million in leveraged long BTC positions liquidated in a single day.

- Government actions: When the news broke that the SEC sued Binance, BTC fell nearly 6%. In contrast, it rallied more than 7% after a US Court of Appeals issued a favorable ruling for Grayscale and its Bitcoin trust.

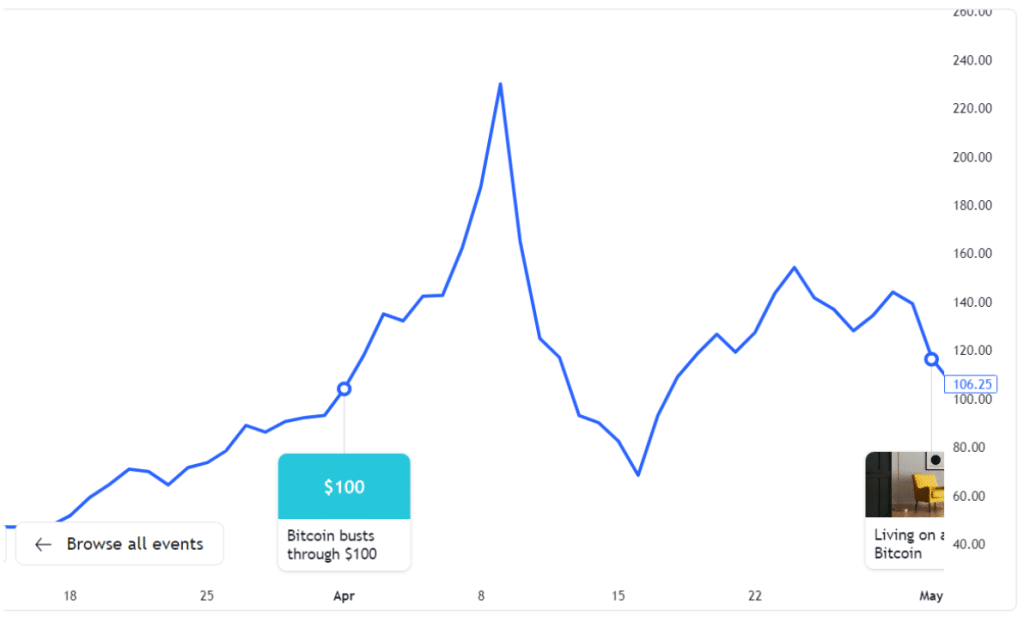

- Financial events: The 2012-2013 Cypriot financial crisis contributed to one of Bitcoin’s most explosive bull runs, pushing BTC into triple digits for the first time as Cypriots looked for an alternative to banks.

What Does Bitcoin Going Up Mean for Investors?

In the short term, Bitcoin’s increase may not mean much at all. Since reaching its recent highs, BTC has already retraced over $6,000, dropping from its record high of over $72,000 to over $65,000.

Ignoring short-term fluctuations, which can be much larger than we’re accustomed to with traditional assets, one Bitcoin will buy 0.67% more than it did one month ago.

Bitcoin’s upward trend, combined with increased awareness and demand from ETFs, could bode well for long-term prices. What was once a fringe asset or even labeled as a way to finance illegal activities is slowly going mainstream. ETF inflows in the first three days of trading approached $1 billion, showing strong interest in investing in BTC.

Increased demand for Bitcoin should fuel increases in value over the long term, but investors shouldn’t expect BTC’s price to go up in a straight line. Pullbacks are normal, and Bitcoin’s total market cap is still relatively small. The largest BTC ETF, Grayscale, has $26 billion in assets. By comparison, SPY, the largest stock-based ETF, boasts nearly $500 billion in assets under management.

Should I Sell My Bitcoin Now?

If you’re sitting on a healthy profit, you can consider selling some of your bitcoin to diversify or start a speculative position with new cryptocurrencies or altcoins. However, timing the market can be tricky, especially for volatile investments like BTC.

IntoTheBlock estimates that about 80% of BTC holders are in profit as of this writing versus just 7% waiting to recover from higher-priced buys. Logically, we should expect some selling pressure.

However, these paper profits aren’t the only consideration. Increased demand could push prices much higher for BTC, perhaps making it wiser to wait especially if crypto makes a full recovery.

Whether to buy or sell is always a personal choice based on your financial situation. If you don’t need to sell Bitcoin, consider the big picture first.

What Makes Bitcoin’s Price Go Up?

Several factors cause Bitcoin’s price to rise and fall, including:

- Supply and demand

- Market sentiment

- Competition from other cryptocurrencies

- Regulatory changes and news

- Technological updates and network security

- Macro-economic indicators

- Institutional adoption and investment

- Media coverage and public perception

- Global economic events

- Changes in the mining ecosystem

Let’s explore the three primary factors affecting the price of Bitcoin — supply and demand, market sentiment, and competition from other cryptocurrencies.

1. Supply and Demand

Supply and demand dynamics directly influence cryptocurrency prices. If demand exceeds supply, prices rise; conversely, if supply exceeds demand, prices fall. Bitcoin’s fixed limit of 21 million coins enhances its value as demand increases. But if investors withdraw due to perceived risks or economic factors, demand decreases, lowering prices.

2. Market Sentiment

Market sentiment drives Bitcoin’s price up or down based on how investors perceive its value. Positive events, like the launch of a Bitcoin ETF, boost investor confidence and demand, raising prices. Conversely, negative publicity or security breaches diminish confidence, reducing demand and driving prices down. Essentially, investor confidence dictates market movements.

3. Cryptocurrency Competition

Market competition impacts Bitcoin’s price as new cryptocurrencies enter the market. If investors and users perceive other coins as more valuable or as promising cryptos, Bitcoin’s demand might decrease, leading to a price drop. Conversely, if Bitcoin maintains its appeal compared to newer options, demand and price increase.

Is Bitcoin Here to Stay?

Yes, Bitcoin is here to stay. Many see it as a store of value, just like gold. The two commodities share some commonalities: scarcity, decentralization, and global acceptance. Let’s explore why each of these factors ensure Bitcoin is here to stay.

1. Scarcity

Bitcoin’s supply is limited to 21 million Bitcoins, with new Bitcoins added through a cost-intensive process called mining. Currently, 19.6 million of the total 21 million are in circulation, with the last Bitcoin expected to be mined in 2140.

2. Decentralization

No government controls the issuance of Bitcoin. Instead, the project is governed by a worldwide community. Any changes to the Bitcoin protocol require adoption by node operators. More than 50,000 Bitcoin nodes operate worldwide. This decentralization makes Bitcoin a digital commodity rather than a security, easing regulatory concerns compared to many other crypto assets.

3. Global Acceptance

Bitcoin was the first cryptocurrency ever. By some estimates, over 219 million people worldwide use Bitcoin. This network effect, combined with the recent approvals of high-profile ETFs, could increase Bitcoin’s adoption and awareness of BTC as a store of value.

Bitcoin brings some additional benefits that enhance its staying power, including portability. Bitcoin wallets make it possible to transport wealth throughout the world and transact with others worldwide without an intermediary.

Bitcoin Market Performance

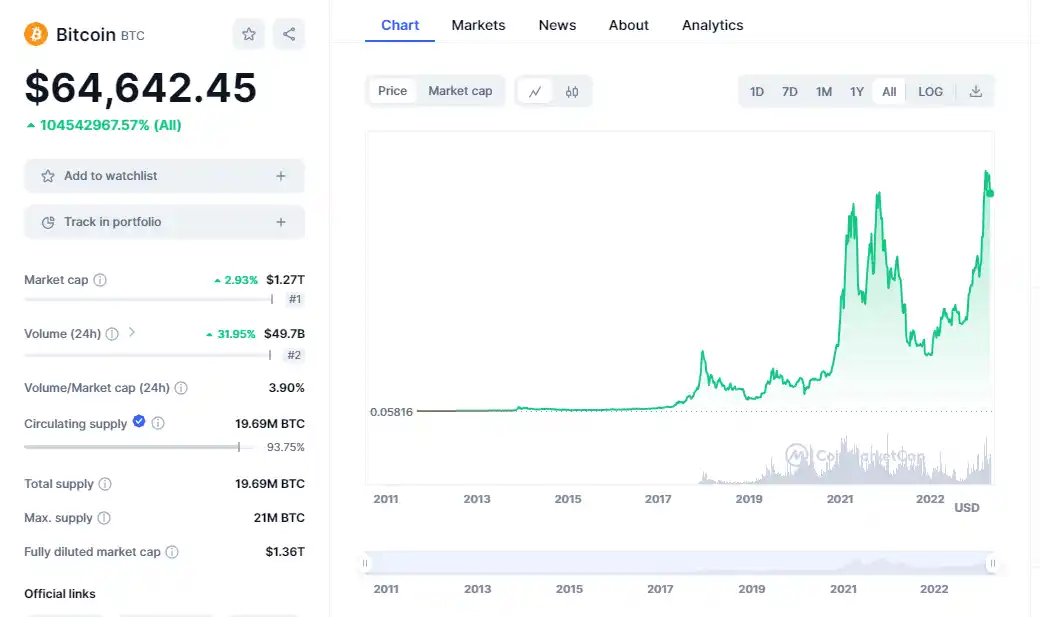

Over the last five years, Bitcoin has experienced a price rise of over 1,044%, from $5,770 to just over $66,000 today. This impressive growth reflects its broader acceptance and appeal as an investment, despite its volatility.

The table below shows the highs and lows of Bitcoin’s price over the last five years, showcasing the sharp price swings driven by economic events, investor sentiment, and regulatory changes.

| Year | Highest BTC Price | Lowest BTC Price |

| 2020 | $28,972 | $4,916 |

| 2021 | $67,145 | $29,971 |

| 2022 | $47,459 | $16,171 |

| 2023 | $44,105 | $16,677 |

| 2024 | $73,097 | $39,833 |

Key moments like halving events and institutional adoption have significantly influenced Bitcoin’s price over the years.

How High Will Bitcoin Go in 2024?

Bitcoin price predictions are interesting, but not always a reliable tool since the industry moves so quickly. Often, price direction offers a more valuable barometer. Nonetheless, we analyzed the data and made some BTC price predictions for 2024 and beyond. For reference, BTC closed out 2023 at $42,265.

| Year | Projected BTC Value | Increase Compared to 2023 |

| 2024 | $62,000 | 46.69% |

| 2025 | $83,000 | 96.38% |

| 2030 | $150,000 | 254.90% |

Bear in mind that our numbers may be conservative. For example, Cathie Wood sees BTC reaching $1.5 million by 2030. Her bear case puts BTC at $258,500, which is still well above our estimates.

Price predictions remain challenging. As another tool, consider support levels to determine risk. Upsides may be unlimited, while downsides may not bring much risk depending on support levels.

Is It Safe to Buy Bitcoin in May 2024?

Many would describe BTC’s price action surrounding the ETF launch as speculation followed by consolidation. After a strong runup, nothing much happened. However, with only 7% of BTC holders riding out losses and the tax-loss selling season safely behind us, there isn’t much reason to expect a large selloff.

Crypto markets are notoriously fickle, however, and it’s just as easy to build a bearish argument as a bullish one, particularly when considering short-term prices. The best solution may be to weigh long-term potential and build a strategy around acquiring BTC over time.

Dollar-cost averaging (DCA) offers a time-tested method of optimizing purchase prices while building a position. The strategy involves purchasing a fixed dollar amount at a set interval, such as $100 per month or $25 per week. More frequent investments smooth out average cost trend lines.

By using DCA, you automatically buy more when prices dip and buy less when prices climb — but you’re always buying. Buying BTC and other cryptos to trade always brings risk, but DCA with an asset unlikely to fall to zero can reduce price risk dramatically.

How to Invest in Crypto During the Bull Market

Investing in a bull market requires strategic entry, selecting strong assets, and capitalizing on market momentum. By understanding the following strategies and timing your investments wisely, you can optimize your returns during a bullish cycle in the crypto market.

1. Choose the Right Cryptos to Buy

During a bull market, selecting fundamentally strong cryptos to buy now is crucial. Look for tokens with innovative technology and strong team backing. Investing in cryptos with proven growth potential can lead to significant gains.

2. Time Your Investments

Invest when the market shows signs of a pullback. These retracements provide a favorable entry point, allowing you to benefit from the subsequent upward trend. Using a DCA strategy can also mitigate volatility risks by spreading your investments over time.

3. Leverage Market Momentum

Engage in momentum trading to capitalize on the upward trend. Use technical analysis tools like RSI or MACD to identify cryptos with strong upward momentum. Buy during upward trends and sell at peaks to maximize returns.

Why Is BTC Up and Other FAQs

Why is Bitcoin going up?

Bitcoin’s recent rise reflects optimism over Bitcoin spot exchange-traded funds (ETFs), the Bitcoin halving, and the prospect of lower interest rates. Bitcoin ETFs offer retail investors and businesses the ability to gain exposure to BTC in trading accounts and potentially retirement accounts.

What makes Bitcoin go up and down?

BTC’s price responds to market forces like industry news and even macro events like interest rate changes or bank troubles. At the heart of Bitcoin’s appeal, however, lies its scarcity; there are only 21 million Bitcoins.

How often does Bitcoin go up and down?

Bitcoin’s price fluctuates frequently, often changing multiple times per day due to factors like market demand, investor sentiment, and global economic events. Its volatility is higher compared to traditional financial assets.

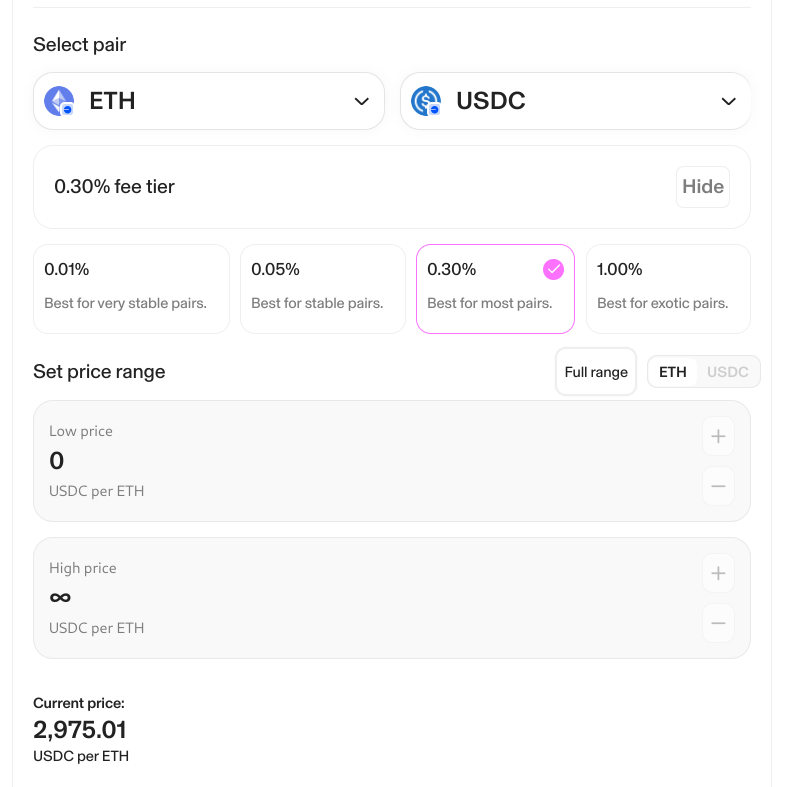

Why is Ethereum going up as Bitcoin goes down?

Ethereum (ETH) and Bitcoin (BTC) often follow similar price trajectories but can vary based on market news. New speculation for an ETH ETF could be keeping ETH’s price afloat while BTC dips following its ETF launches.

Why is Bitcoin up, but Bitcoin Cash is down?

Bitcoin is more widely recognized as a store of value compared to Bitcoin Cash. Investment inflows to one cryptocurrency, boosting prices, often come at the expense of outflows in another.

What is Bitcoin worth today?

As of this writing, BTC trades between $65,000 and $66,000.

Is Bitcoin the safest crypto to buy?

Many investors consider Bitcoin the safest crypto because it represents about 50% of the crypto market and has the best name recognition worldwide. Additionally, newly launched Bitcoin spot ETFs may help create a floor in trading as new traders enter the market at the current price.

References

- CoinGlass: Liquidation Heatmap

- FinTech Magazine: Bitcoin Halving Event: How Will it Affect the Crypto Market?

- CryptoNews: Bitcoin’s Fourth Halving Imminent: Less Than 100 Blocks Away – Here’s What Happens Next

- CryptoNews: Spot Bitcoin ETFs and Halving Mark Milestones – What Lies Ahead for Crypto?

- Forbes.com: Terra-Luna Founder Do Kwon Transferred $7 Million To Law Firm Just Before Coin’s Collapse That Triggered Crypto Meltdown

- CNBC.com: Bitcoin rallies more than 7% as court sides with Grayscale over the SEC in crypto ETF case

- Theatlantic.com: Everything You Need to Know About the Cyprus Bank Disaster

- Bitnodes.io: Global Bitcoin Nodes

- Crypto.com: Global Cryptocurrency Owners Grow to 425 million

- Coindesk.com: Bitcoin ETF Net Inflows Near $1B After Three Days

- Finance.yahoo.com: Grayscale Bitcoin Trust (BTC) (GBTC)

- Finance.yahoo.com: SPDR S&P 500 ETF Trust (SPY)

- App.intotheblock.com: IntoTheBlock – On-Chain Crypto, DeFi & NFT Analytics

- Finance.yahoo.com: Bitcoin USD (BTC-USD)

- Coindesk.com: Cathie Wood Sees Bitcoin Price Reaching $1.5M by 2030 After ETF Approval

- Statista: Number of cryptocurrencies worldwide from 2013 to January 2024

Alan Draper

Alan Draper

Viraj Randev

Viraj Randev

Kane Pepi

Kane Pepi